|

A budgeting process is boring, long-term and the rewards to following a budgeting process are only enjoyed much later on. This could explain why people fail to stay committed to their budgeting process. However, these are not the main reasons.

The main problem are your emotions. Greed, anger, frustration, hate, sadness and desperation – these are examples of emotions that cause people to commit crimes against each other, to rob and steal from each other….and also fall of the bandwagon when trying to follow a budgeting process. So, how does this impact your ability to stay focused on following a budgeting process and what sort of negative emotions are at play here? Most of us, experience the following:

These are only some of the kind of issues we have to contend with on a DAILY basis. With all of this going on, no wonder we are over-flowing with negative emotions from the time we wake up to the time we go back to bed and we repeat this process all over again every day. If a budgeting process is a long-term commitment in achieving some sort of long-term success (or long-term financial freedom), then why do we battle to stay committed? When you buy a new car, you take out a loan in a bank and that is generally a 5 to 6 year commitment. When you buy a new home, you get a new mortgage and this is generally a 20 year commitment. 20 years is a LONG TIME to commit to something. So, why do we battle to stay committed to a budgeting process? After all, we adopt a long-term commitment to financial responsibilities all the time. Here is the answer…. The negative emotions we experience are felt on a daily basis. The brain will provide ways or alternatives to coping with these issues. The brain gives you relief from all of these negative emotions by justifying the need to indulge or splurge a.k.a. instant gratification. For example:

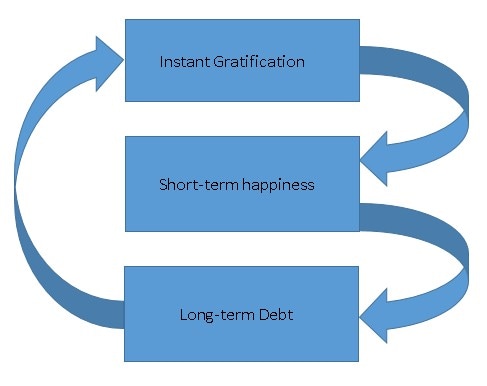

At the end of the year, when you do another evaluation on your finances to see how deep in trouble you really are, then you realize that spending money you don’t have, has lead you deeper into the financially broke money pit that you dug for yourself. Now you blame the rest of the world and tough economic situations as the root cause of your demise. The truth is, you are constantly surrounded by so much of negative emotional situations that the brain needs to find a way to break free and provide some relief (even if it is temporary relief), you fall victim to marketing strategies from million dollar corporations and spend your hard earned money (or the bank’s money) and you end up no longer following a budgeting process. Every time you realized you were about to break away from your budgeting process, you made sure you justified the behavior which allowed you to feel better about breaking your own rules. YOU ARE YOUR OWN WORST ENEMY!!! Yes, sometimes there are extenuating circumstances that are beyond your control that lead to you deviating or worse completely ignoring your budgeting process but these situations are few and far between. Be honest and be true to yourself! Most of the time when you end up using money you were not supposed to, it was because of instant gratification and this helped you feel better about yourself and your life situation. Does any of the below statements sound familiar to you? “….I work hard for my money and deal with a lot of issues ALL THE TIME, I earned the right to spend this today….” “…I promise to get back on track from next month. I promise to start budgeting properly next month….” “….you only live once. I could die tomorrow, so saving all this money would not have mattered…” “….yes I want to budget better but I’m not going to drop my standard of living. I have gotten used to this lifestyle….” Find a way to overcome the urge of deviating from your budgeting process, overcome these emotions of short term instant gratification with your money and you will achieve long term financial success. Remember, instant gratification leads to short-term emotional relief which provides long-term debts which results in more negative emotions about your finances which causes more frequent instances of instant gratification to overcome those negative emotions which provides more short-term relief, which provides more long-term debt and so the vicious cycle will continue.

0 Comments

|

RSS Feed

RSS Feed